FICA Savings Calculator

Number of Employees:

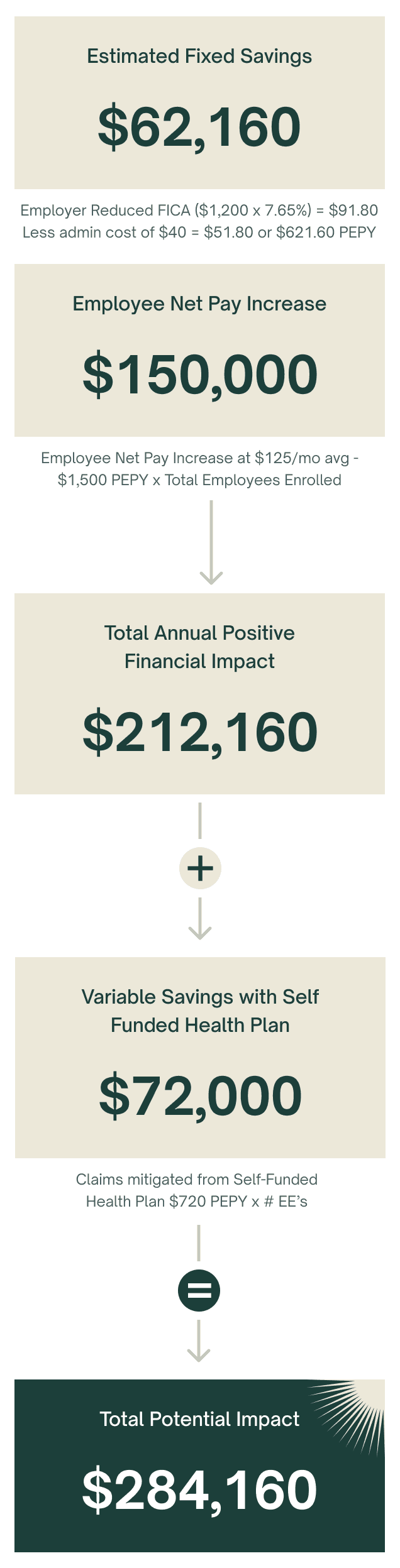

Estimated Annual FICA Tax Savings

01 — Benefits for Employer

Reduce total company FICA Tax spend

On average save $800 per Employee Annually

The program offers

supplemental benefits that can be beneficial tools in

recruiting and employee retention

Learn More

02 — Benefits for Employees

Employees may increase take-home pay by $1,500 per year.

Benefits begin the first month of enrollment

Employees can access

top-tier virtual care, no co-pay visits, no co-pay RX,

and preventative physical/mental

Added Employee Benefits

• Hospital Indemnity Plan

• Unlimited Virtual: Primary Care, Urgent Care,

Behavioral Care, and Dermatology

• Rx Benefits - 2900 of the most readily used Rx

• Saving on Vision, Hearing, Imaging and More

• Robust Dental Savings Program

• Metabolic Testing

How much can Employees Save?

*The above is an example using sample information. Our program cannot guarantee the same favorable tax outcome in all situations as federal and state tax laws are continuously changing. The benefits paid under this program may be taxable income. We recommend each group seek tax advice from a professional tax advisor prior to purchasing. Premium is solely for the fixed indemnity plan, the employee may get Telemedicine and Preventative Health Programs. The premium is solely for the fixed indemnity plan.